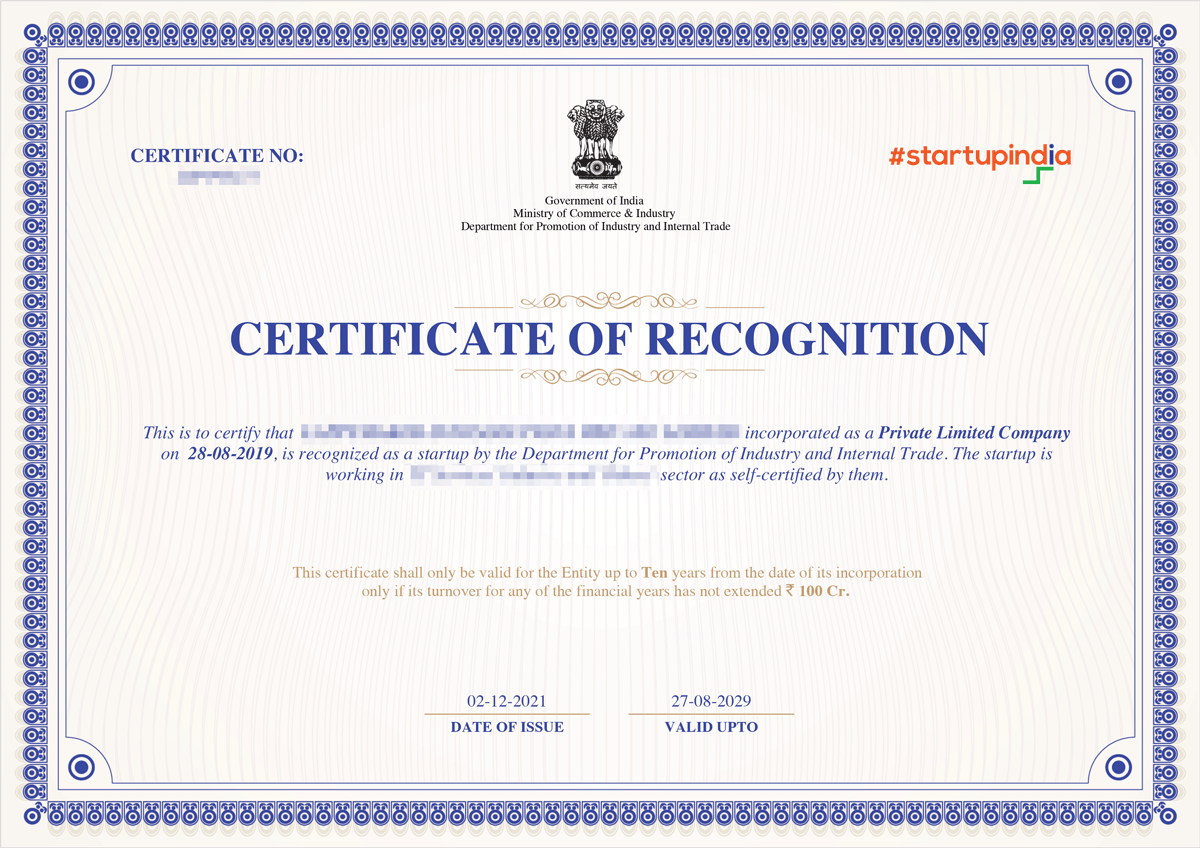

Startup India Registration

Want to buy a Digital Signature Certificate online and quickly? Blue Box Compliance is India's best provider of digital signatures. We can provide a Class 3 DSC and digital signature certificate online registration in just 3 easy steps!

- Expert assisted startup India registration process

- Get your startup India certificate and access government funding

- Legal advice and filing support to register a startup in India

Get Legal Assistance

12+ Awarded

Top CA, CS Professionals

100+ Business

Consult Every Month

1500+ Fillings

Done Every Month

2500+ Company

Incorates till now.

Startup India Registration

The Startup India Registration initiative, launched in 2016 by the Government of India, aims to transform India into an innovation hub. Eligible startups (under 10 years old with turnover below ₹100 crore) gain cost reductions on IP filings, fast-tracked patent processing, and tender access without prior experience.

Benefits of Startup India Recognition :

- Self-Certification

- Tax Exemption under 80-IAC

- Easy Winding of a Company

- Fast-tracking of Startup Patent Applications

- Rebate on filing of Patent Application

- Easier Public Procurement Norms

- Exemption under Section 56

- GeM Portal preference

15+ Years

Of experience in business service

Startup India Registration Eligibility

The Startup India eligibility criteria cover three broad areas: turnover, startup age, innovation requirements, scalability potential, and sector-specific conditions. Here is a detailed outline for the same:

Age Limit

The startup should not exceed ten years from the date of incorporation or registration.

Turnover Limit

The annual turnover of the startup during any of the financial years since incorporation shall not have exceeded ₹100 crore

Innovation Criteria

The business should contribute to innovation and add value to existing products or services, distinguishing it from other companies in the market

Scalability Potential

Startups must demonstrate high scalability, with the potential to generate substantial wealth and create employment opportunities

Sector-Specific Requirements

Any sector or industry based startup can avail this facility under the Startup India Scheme except those who qualify for primary eligibility criteria.

Startup India Registration

Startup India registration promotes innovation and development by offering benefits like tax exemptions, funding access, simplified compliance, and intellectual property protection.

Documents Required for Startup India Registration

- Company incorporation or registration certificate

- Funding proof - If applicable, evidence of any financial backing received

- Authorisation Letter from the company’s authorised representative

- Concept proof like Business Plan, Pitch Deck or a video demonstrating the startup's idea

- Patent and trademark details

- List of awards or certificates for your startup

- PAN (Permanent Account Number)

Startup India Registration Process

- Step 1: Details & Documentation

- Step 2: Drafting & Uploading Documents

- Step 3: Application for startup India registration

- Step 4: Verification by DPIIT

- Step 5: Approval & rejection of application

DPIIT Startup India Registration Fees

- Professional Charge Rs. 4,999

- Time taken in the process 7-10 days

Have a question? Check out the FAQ

Digital Signature Certificate (DSC)

How does Startup India differ from other startup schemes?

Startup India stands out by offering a comprehensive support system, including tax exemptions, easier compliance, and access to government funding. Unlike other schemes, it focuses on innovation, scalability, and reducing regulatory burdens. It also provides a platform for networking, mentorship, and leveraging intellectual property protection.

Can a foreign-owned startup register under Startup India?

No, a foreign subsidiary cannot be registered under the Startup India scheme. But a company with foreign shareholders and directors can be registered under the Startup India scheme.

What is the role of incubators in the Startup India Scheme?

Incubators play a crucial role by providing startups with mentorship, funding opportunities, office space, and networking. Under the Startup India Scheme, incubators help startups refine their business ideas, attract investors, and scale their operations, ensuring long-term growth and success through specialised support and resources.

Are startups tax free in India?

Yes, startups are exempted from certain taxes under section 56 and 3 years of tax holidays after getting startup india certification from DPIIT.

Corporate Filings

Manage corporate filings, such as tax returns, share certificates, and statutory forms

Legal Advice

Provide expert advice on company law, conflicts of interest, and other legal matters

Corporate Planning

Develop corporate strategy and planning

Accounting Advice

Provide accounting advice on financial reports

Clients

Companies Registered

Annual Compliance Support

Professionals

Testimonials

What our reputated client talk about services.

Amit Khurana

Director

Blue Box Compliance has been a game-changer for our company. Their compliance health check helped us avoid penalties and stay ahead of deadlines effortlessly.

Priya Sharma

Founder

Incorporating my startup was smooth and hassle-free, thanks to the expert team at Blue Box Compliance. They handled everything from ROC filings to legal documentation with precision.

Neha Verma

HR Head

From HR compliance to taxation and regulatory filings, Blue Box Compliance has been our trusted partner. Their automated systems make compliance effortless.

Rahul Mehta

CFO

Their deep knowledge of compliance laws and structured approach gave us complete peace of mind. The team is professional, proactive, and always available for support.

Worried about compliance? Let’s simplify it for you!

Schedule a FREE compliance health check today and safeguard your business from legal risks.

Company Health Compliance